5 Key Metrics Every Small Business Should Track for Sustainable Growth

Introduction

For small businesses, measuring success isn’t just about increasing sales or growing your customer base—it’s about tracking the right Key Performance Indicators (KPIs) that reveal how well your business is operating. By focusing on these metrics, you can make informed decisions, optimize processes, and ensure sustainable growth over time.

In this post, we’ll dive into the five essential metrics that every small business should track to drive long-term success.

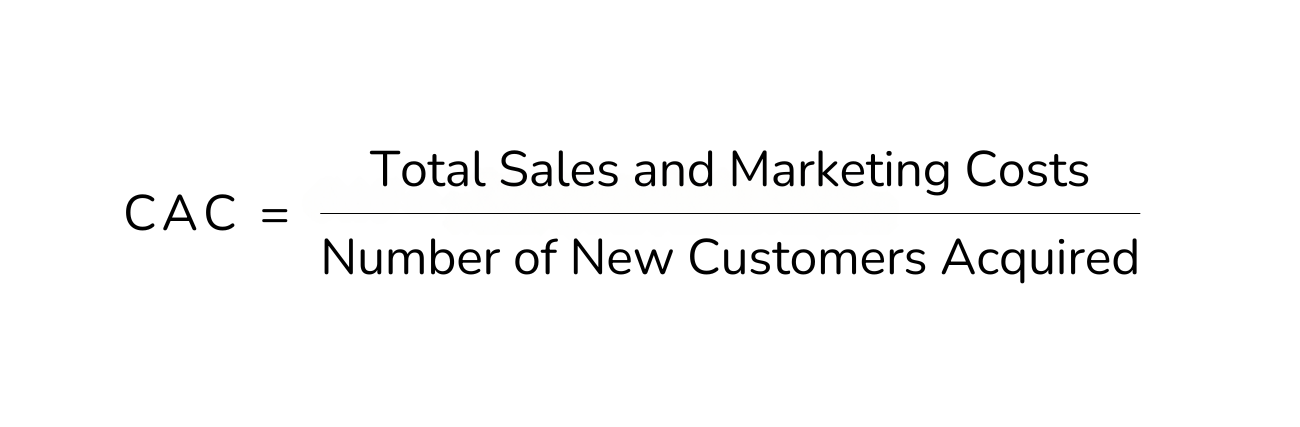

1. Customer Acquisition Cost (CAC)

What is it?

Customer Acquisition Cost (CAC) measures how much it costs to acquire a new customer, taking into account your marketing and sales expenses. This includes everything from paid ads to salaries of sales and marketing teams.

Why it’s important:

If your CAC is too high, your business won’t be profitable, even if you’re generating revenue. Tracking CAC helps you identify whether your customer acquisition strategies are cost-effective and allows you to allocate your marketing budget more efficiently.

How to calculate it:

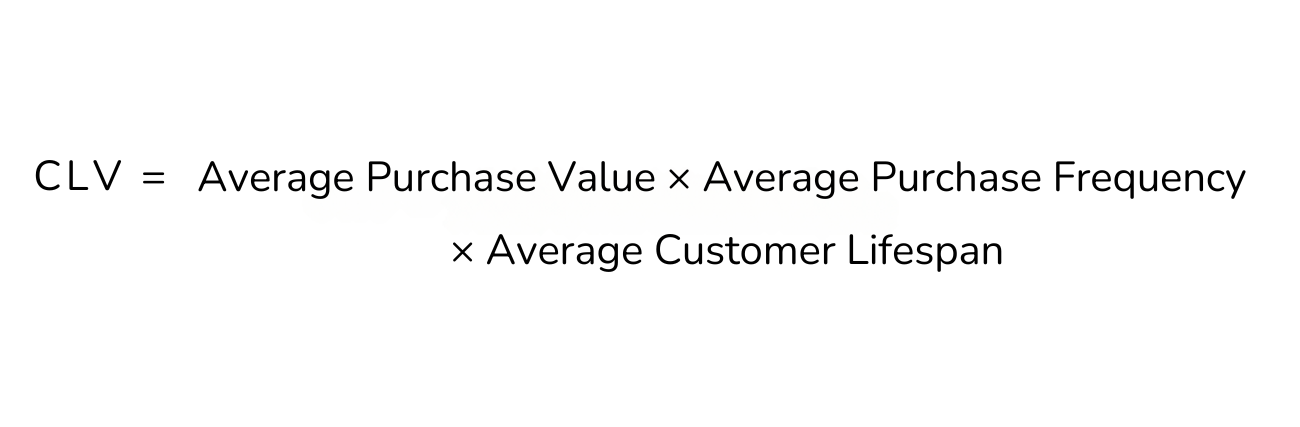

2. Customer Lifetime Value (CLV)

What is it?

Customer Lifetime Value (CLV) represents the total revenue you can expect from a customer throughout the entire duration of their relationship with your business. CLV takes into account how much a customer spends on average and how often they return to make purchases.

Why it’s important:

Understanding CLV allows you to focus on long-term customer relationships rather than short-term gains. If your CLV is higher than your CAC, you’re on the path to profitability. It also helps you tailor your marketing and customer retention strategies for higher returns.

How to calculate it:

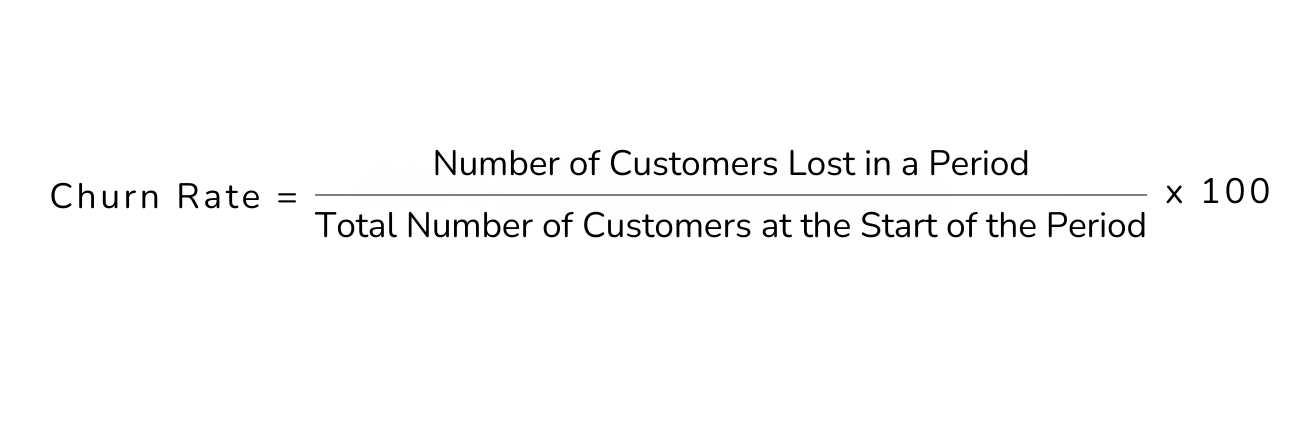

3. Churn Rate

What is it?

Churn rate measures the percentage of customers who stop doing business with you over a specific period. This is especially important for businesses with a subscription model, but any small business should monitor churn to understand customer retention.

Why it’s important:

A high churn rate means you’re losing customers faster than you can acquire them, which will ultimately limit your growth. Reducing churn is one of the most cost-effective ways to boost profitability because it’s typically much more expensive to acquire a new customer than to retain an existing one.

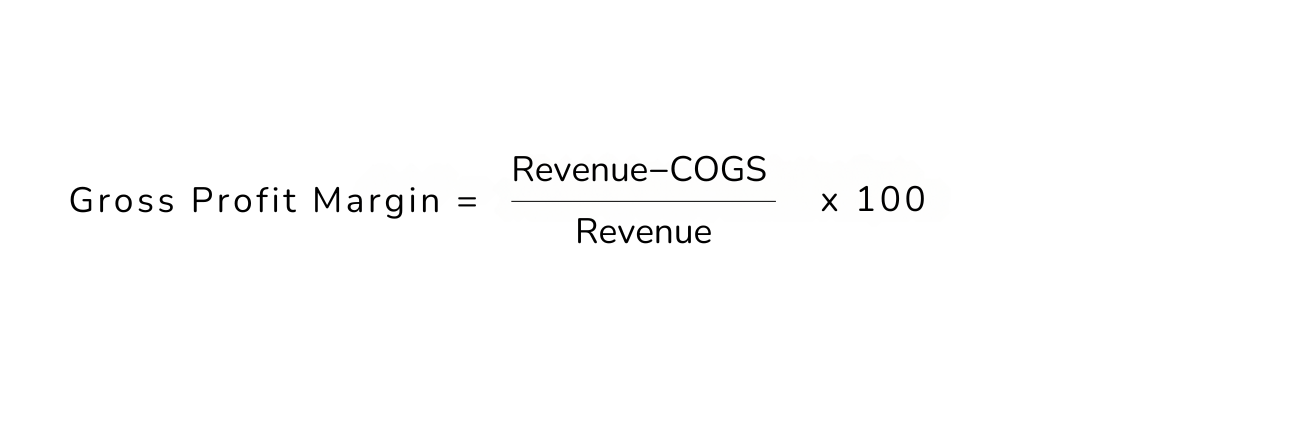

4. Gross Profit Margin

What is it?

Gross profit margin is the percentage of revenue left over after accounting for the cost of goods sold (COGS). It reflects how efficiently your business is producing and delivering its products or services.

Why it’s important:

Tracking your gross profit margin helps you understand how well your business is performing financially. A healthy profit margin means that your business can cover operational costs, invest in growth, and generate profit. If your margins are shrinking, it might be time to revisit pricing, supplier contracts, or operational efficiency.

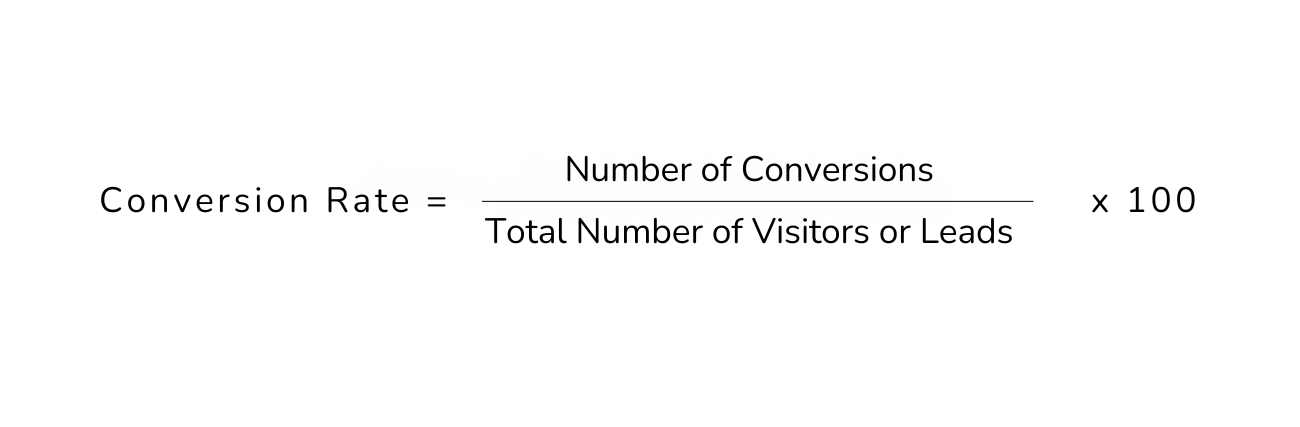

5. Conversion Rate

What is it?

Conversion rate measures the percentage of leads or visitors who take a desired action, such as signing up for a newsletter, making a purchase, or filling out a contact form. It’s a direct measure of how effective your marketing efforts are in turning prospects into paying customers.

Why it’s important:

Improving conversion rates means getting more value from the same amount of traffic or leads, which directly impacts your bottom line. A higher conversion rate translates to more customers and revenue without increasing your marketing spend.

Conclusion

Tracking these five key metrics—Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), Churn Rate, Gross Profit Margin, and Conversion Rate—will give you a clearer understanding of your business performance. These metrics help you make informed decisions, identify areas for improvement, and ensure sustainable growth for your small business.

By regularly monitoring these KPIs, you can adjust your strategies to improve efficiency, reduce costs, and maximize customer value, setting your business on a path for long-term success.